Income Tax E-Filing Software

Price 2900 INR/ Number

Income Tax E-Filing Software Specification

- Compatible System

- Windows & Mac OS

- Security Features

- Password Protection, Data Encryption

- Usage

- For Individual and Professional Use

- Support System

- 24x7 Technical Support

- Interface Type

- Online/Web-Based

- Language Support

- English, Hindi

- Capacity (Person)

- Single and Multi-User Versions

- Type

- Accounting & Taxation Software

- Application

- Income Tax Return preparation and E-filing

- User Training

- Comprehensive User Guides & Tutorials

- Import/Export Facility

- Excel/PDF Data Import & Export Functions

- Mobile Access

- Mobile Responsive Design

- Document Management

- Bulk Upload, E-Document Storage

- Data Backup

- Cloud-based and Local Backup Options

- Audit Trail

- Integrated Audit Trail for User Activities

- Integration

- Compatible with TDS/TCS, GST, and Accounting Software

- Update Frequency

- Annual & Timely Updates as per Government Regulations

- Technical Requirements

- Requires Active Internet Connection

- Reports & Analytics

- Automated Tax Reports, Filing Status, Summary Charts

- Customization Options

- Customizable Forms & Data Fields

Income Tax E-Filing Software Trade Information

- Minimum Order Quantity

- 1 Number

- Payment Terms

- Cash in Advance (CID)

- Supply Ability

- 10 Per Month

- Delivery Time

- 5-7 Days

- Main Domestic Market

- All India

About Income Tax E-Filing Software

Special Features & Application Places

This income tax e-filing software is tailored for elite use in accounting firms, enterprises, and by individual taxpayers. Key features include document bulk upload, customizable forms, automated analytics, and e-document storage. Its mobile-responsive design allows instant filing on the go, while being compatible with TDS/TCS, GST, and renowned accounting software. Offering both single and multi-user capacity, it supports English and Hindi for widespread usage in offices, homes, and professional setups.

Supply Ability, Express Shipping & Certifications

Our prodigious supply ability ensures sizeable proposal amounts for bulk buyers, traders, suppliers, and wholesalers across India. With express shipping options, orders are swiftly dispatched from designated FOB ports. Certified for compliance with accounting and security standards, the software guarantees trusted operations. Whether for individual or corporate use, each unit is delivered under controlled conditions, making your acquisition smooth and reliable.

FAQs of Income Tax E-Filing Software:

Q: How does the software update its features according to government regulations?

A: The software receives annual and timely updates in direct accordance with the latest government regulations, ensuring compliance for every filing period.Q: What is the process for backing up data within the system?

A: Users can back up their data using both cloud-based and local backup options, enabling secure storage and easy retrieval of historical records.Q: Where can the e-filing software be used effectively?

A: It can be used in accounting firms, businesses, or by individual taxpayers in India, and supports single or multi-user operations on both Windows and Mac OS platforms.Q: When is user activity monitored by the audit trail?

A: An integrated audit trail monitors and logs all user activities instantly, providing a detailed record for compliance and security audits.Q: What are the benefits of integration with TDS/TCS, GST, and accounting software?

A: Seamless integration allows users to automate tax calculations, import or export financial data, and streamline reports for effective compliance and management.Q: How can users access help and training materials for the software?

A: Users have round-the-clock access to comprehensive guides, tutorials, and 24x7 technical support for quick assistance and smooth onboarding.

Price:

- 50

- 100

- 200

- 250

- 500

- 1000+

More Products in Software Products Category

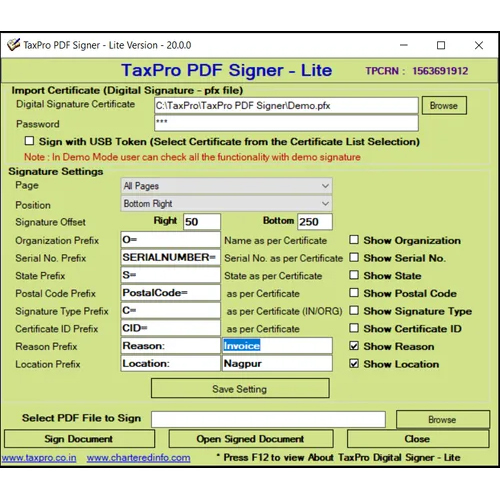

TaxPro Bulk PDF Signer Software

Price 8000 INR / Number

Minimum Order Quantity : 1 Number

Language Support : English

Interface Type : Userfriendly GUI, draganddrop functionality

Capacity (Person) : Supports unlimited users per license

Type : Other, Bulk PDF Signing Software

Windows Signer Digital Software

Price 18000 INR / Number

Minimum Order Quantity : 1 Number

Language Support : English

Interface Type : Graphical User Interface (GUI)

Capacity (Person) : Multiple users

Type : Other, Digital Signature Software

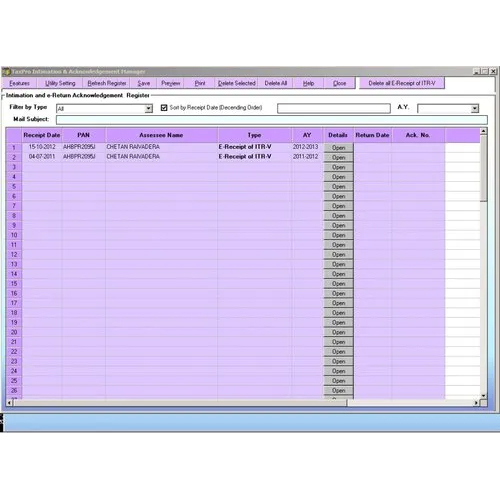

E-TDS Return Filing Software

Price 3500 INR / Number

Minimum Order Quantity : 1 Number

Language Support : English.

Interface Type : Userfriendly graphical interface with stepbystep guidance.

Capacity (Person) : Multiuser access support.

Type : Other, ETDS Filing Software.

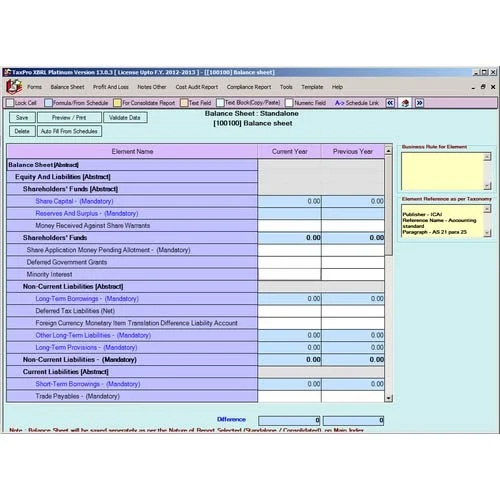

XBRL Conversion Tool Software

Minimum Order Quantity : 1 Number

Language Support : English, Hindi

Interface Type : Windows GUI

Capacity (Person) : Multiuser

Type : Other, XBRL Conversion Tool

Send Inquiry

Send Inquiry Send Inquiry

Send Inquiry